Having an Lasting Power of Attorney (LPA) is every bit as important as having a Will

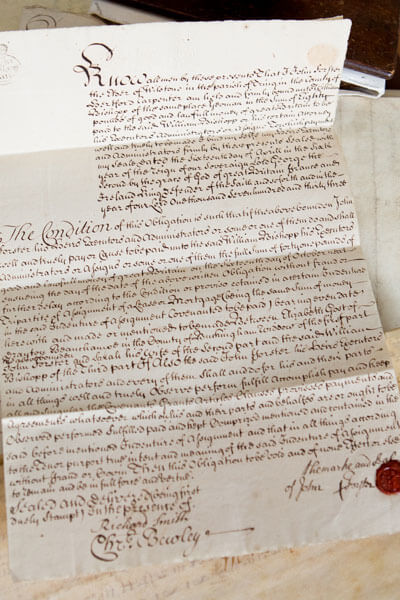

A LPA is a document that can come into effect if, at some time in the future, you become unable to administer your own affairs.

There are two types. One deals with Property and Affairs and the other with your Personal Welfare.

What would happen if you became unable to deal with your financial affairs due to an accident, because of illness or through old age? People often assume that a member of the family can step in to deal with things, but the situation is not that straightforward.

If you are physically unable to deal with your own affairs and would prefer someone else to deal with things for you, it may not be legally possible for them to do so unless there is an LPA in place.

If you no longer had mental capacity to make decision about financial matters, without a LPA your family would have to apply to the Court of Protection for orders dealing with your assets. This is a costly and time consuming process than using a power of attorney and there could be delays causing problems with paying bills, providing for your dependants or continuing to run a business.

The good news is that there is a way to avoid these problems. You can set up an LPA now, to provide for future difficulties. The Property and Affairs LPA states who will deal with financial arrangements on your behalf, so you can nominate trusted friends or relatives or a professional adviser. A Personal Welfare LPA allows you to nominate an attorney to make decisions about your welfare. You can set strict limits on the Attorney’s powers, and cancel it at any time before you lose capacity.

Before an LPA can be used it is registered with the Office of the Public Guardian. This is fairly straightforward and avoids the more complex process of the Court of Protection when there is no LPA.

Please see here for details of our charges for Lasting Powers of Attorney

If you are concerned about a family member who is having difficulty managing their affairs, we can also help with the Court of Protection.

Our Private Client team are highly experienced in dealing with LPAs. To contact us, please telephone one of the numbers below or use the on-line enquiry form and we will contact you.

If you would prefer to see someone at home, or if you are in hospital or a care home, we can visit you at home at no extra cost. We will provide you in advance with information about the cost of our services.

T 01582 456222

T 01442 872141

Anthony Pratt ap@austinslaw.com

James Houghton jh@austinslaw.com